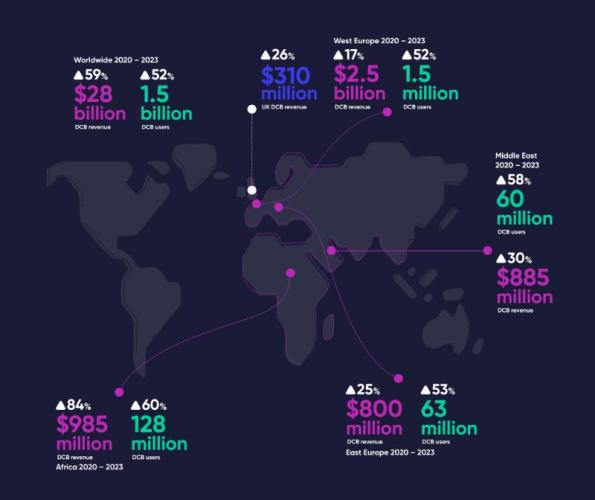

The Direct Carrier Billing (DCB) industry will boom over the next three years, reaching US$28bn in global revenue by 2023, according to a research

Carried out by Mobilesquared, independent analysis of the mobile payment method maps out user and revenue growth on a global scale, with the technology projected to reach 1.5bn users in the same time period.

Commissioned by PM Connect, the findings show that DCB in the Middle East is set to surge ? where as an emerging market the technology will see a higher growth of DCB converts. Middle East revenue is set to rise by 30 per cent from US$680mn to US$885mn by 2023, with a 58 per cent increase in users from 38mn rising to 60mn.

Chris Purdie, group commercial director at PM Connect, commented, ?The past five years have seen mobile content become king, with mobile internet usage now accounting for 52 per cent of web-page views around the world.?

?While the current climate has presented undoubted challenges across industries, it has underlined the power of the smartphone for communication and payment. Mobile internet use has surged by 50 per cent in some markets, as consumers look to their phones as the best way to stay connected to their favourite brands ? coupled with an increase in organisations communicating to their audiences via SMS.?

?Slotting neatly into this mobile ecosystem, DCB is a more universal way to pay ? bypassing the need for long sign-up processes or inputting bank account details, alongside transparent direct communication. We hope this research demonstrates what an exciting time it is for our industry, proving it is a payment method on the cusp of hitting the mainstream.?

In terms of consumer sector growth, the highest will be in mobile ticketing (mTicketing) and health and fitness, alongside in-demand sport content. By 2023 this will see 39 per cent of smartphone users regularly access lifestyle and sports content, tickets, videos, news articles and more through DCB payments ? with the number increasing from just 19 per cent in 2018, and 26 per cent today.

?In the Middle East, there will be more first-time users converted to DCB over the next few years than ever before. UAE has seen a sharp rise in users, but Saudi Arabia, Qatar, Kuwait, Oman and Bahrain are not far bar hind in terms of growth.?

?This is democratising content for users in emerging markets by making world-leading brands more accessible. For brands, DCB can help increase not only revenue but reach, driving wider interest and connecting with new fans in these territories.?

?As we see mobile phone usage and the role of data packages becoming increasing influential around the world, with the right long-term vision the potential of DCB is exponential.?

Find out more in the full report, downloadable from the PM Connect website pmconnect.co.uk/whitepaper/the-future-of-dcb/