In a strategic move advancing the UAE’s sustainability agenda, ServeU LLC, the facilities management subsidiary of Union Properties PJSC, has entered a partnership with PureBlue Water, a Dutch specialist in decentralised wastewater treatment technologies

The collaboration aims to deploy advanced distributed water treatment systems across residential, commercial, industrial, and leisure developments throughout the UAE.

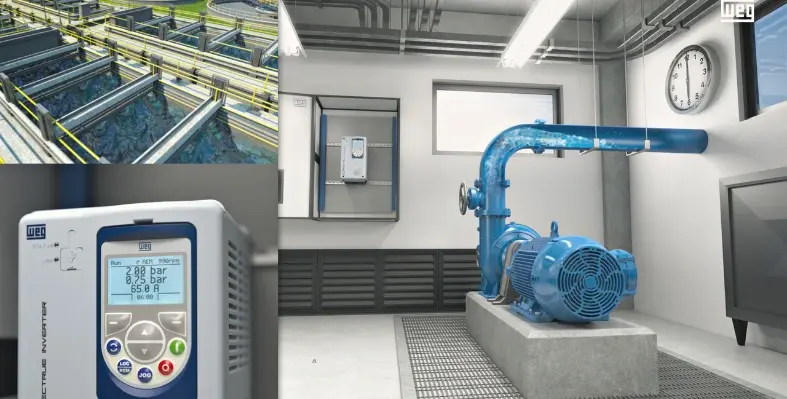

ServeU brings its extensive regional presence and integrated facilities management capabilities, while PureBlue Water contributes its compact, high-efficiency treatment modules designed to operate at source rather than rely on large centralised sewer networks. These systems bypass extensive pressurised pipelines and traditional large-plant infrastructure, offering faster deployment, reduced construction and maintenance costs, and enhanced operational efficiency. The treated effluent is suitable for reuse on-site, such as for irrigation of golf courses, rooftop gardens, and shaded community spaces, thereby conserving freshwater resources and promoting greener landscapes.

Aligned with the UN Sustainable Development Goals and the UAE’s climate action objectives, this initiative underscores a shift toward circular economy water management and sustainable infrastructure delivery. ServeU’s commitment to embedding sustainable solutions across its operations is reinforced through this venture, as the company accelerates its transformation into a provider of smart, environmentally conscious built environment services.

Together, ServeU and PureBlue Water are delivering a model for the future, where modern infrastructure supports efficient water reuse, cost-effective operation, and the creation of sustainable ecosystems across the UAE’s built environment sectors.