Carbon capture is widely recognised as a cornerstone in achieving net-zero goals

Dr. Steve Griffiths, professor and vice chancellor for research at American University of Sharjah (AUS), is at the forefront of research into cutting-edge carbon capture technologies that could help transform the Middle East’s carbon-intensive industries. Speaking to Technical Review Middle East, he discussed the findings of a recent study, co-authored by AUS and Heriot-Watt University, which explores innovations ranging from advanced amine blends to electroswing systems, metal-organic frameworks, and their integration into the region’s sustainability agenda.

Carbon capture is widely recognised as a cornerstone in achieving net-zero goals, particularly in sectors such as oil and gas or cement, where emissions are difficult to eliminate. According to Dr. Griffiths, chemical absorption using blended amine solutions represents the most immediately viable option for the region’s carbon-intensive (or “hard-to-decarbonise”) sectors.

Dr. Steve Griffiths, professor and vice chancellor for research at American University of Sharjah

“According to our paper, these are the most established CC technology, with MEA/MDEA blends achieving over 30% reduction in regeneration energy compared to single solvents,” he said. These systems have already seen proven industrial deployment, with facilities like Boundary Dam serving as examples. The oil and gas industry’s existing experience with gas processing technologies, he explained, makes adoption more feasible.

For cement production, the potential is equally promising. “Amino acid salts have been successfully tested at the Siemens Meri-Pori CCS project in Finland and so further options are in the pipeline,” he added.

Reducing energy consumption

Electroswing technologies, while promising, particularly due to their ability to operate at ambient temperatures of 25-40°C, remain unproven at commercial scale.

One of the most compelling aspects of these innovations is their ability to reduce the energy demands of carbon capture, which has historically been a major barrier to adoption. “Our paper confirms that advanced solvent blending reduces energy consumption by over 30%,” Dr. Griffiths said.

Traditional monoethanolamine (MEA) systems, he explained, require 0.9-1.2 MWh per ton of CO2 for regeneration, accounting for 70-80% of operating expenses.

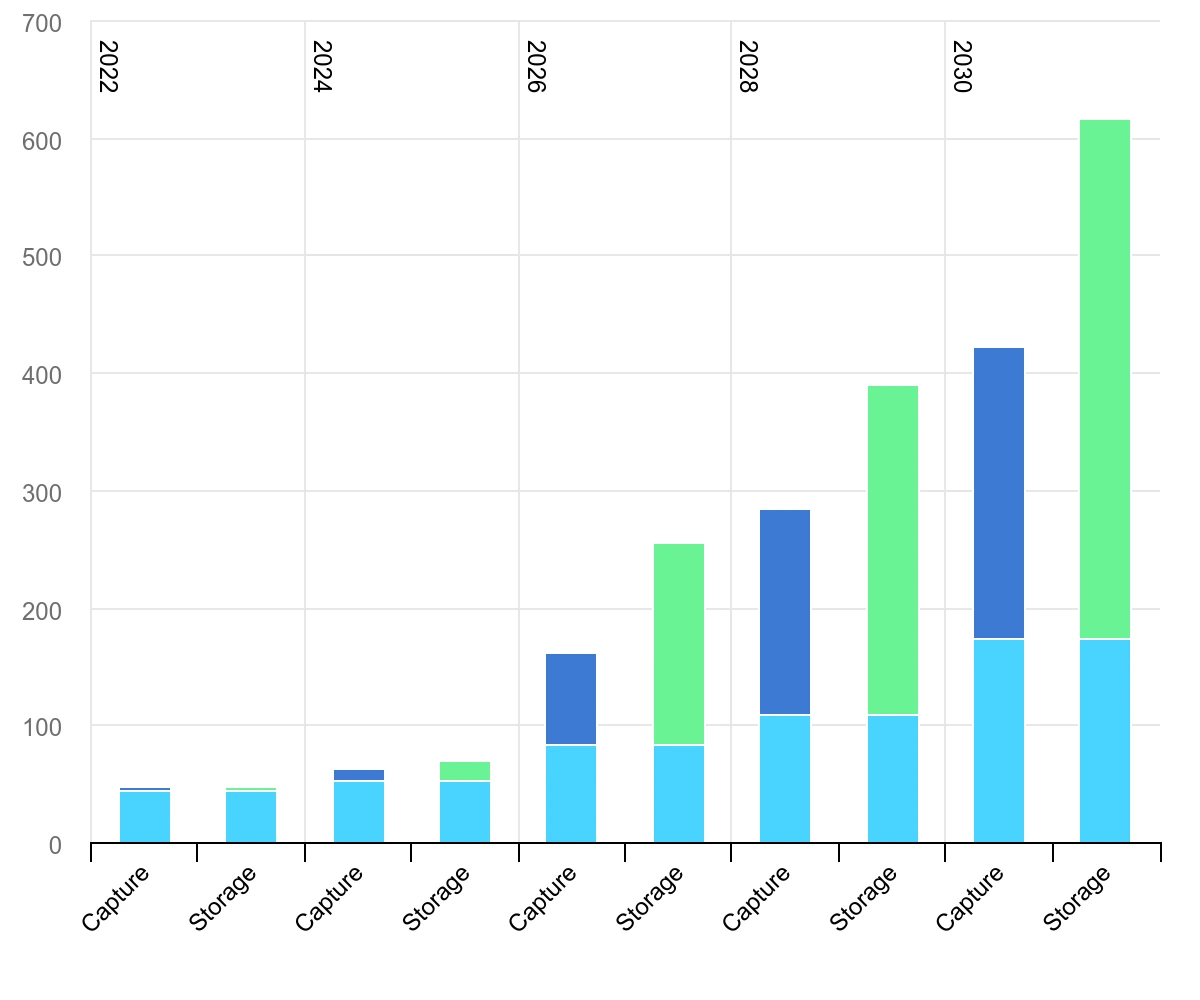

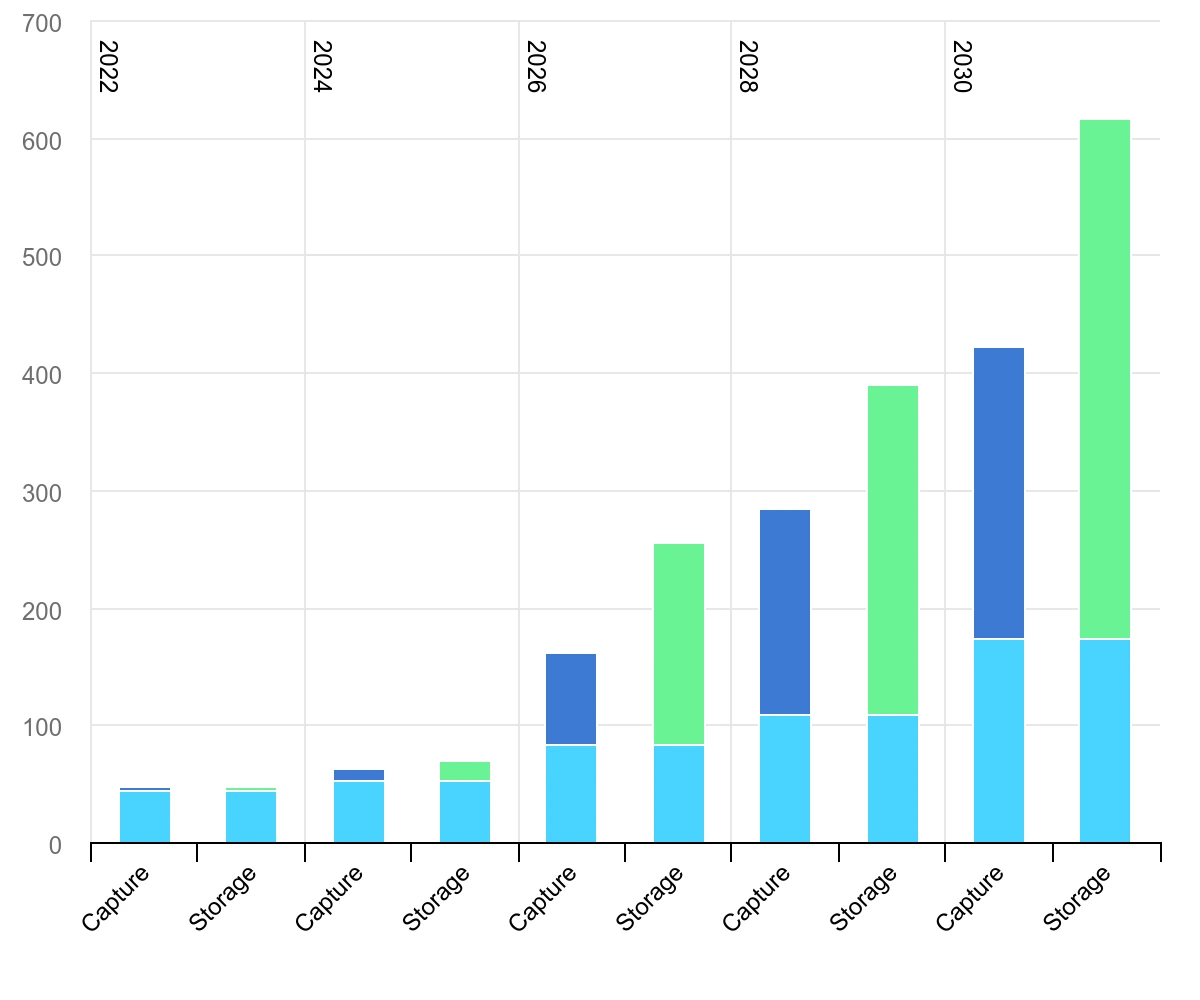

Annual CO2 capture capacity vs CO2 storage capacity, current and planned, 2022-2030. (Image source: IEA)

By blending MDEA with MEA and using phase-split solvents, these requirements are significantly reduced. “Electrochemical regeneration enables operation at 40-80°C compared to typical MEA regeneration at 125°C, reducing both energy requirements and amine degradation,” he noted.

From a cost perspective, the study’s findings suggest encouraging possibilities.

“Our paper’s Figure 1 shows capture costs ranging from US$50-175 per ton CO2 depending on the source and technology, with natural gas processing at the lower end and cement/power sectors at the higher end,” Dr. Griffiths said.

Another area drawing increasing attention is the use of metal-organic frameworks (MOFs), which offer high efficiency in selectively capturing CO2. While still under development, progress is accelerating. “Metal-organic frameworks are advancing toward industrial deployment with pilot tests currently underway,” he said. MOF-74 variants are being tested at General Electric Gas Power and Drax Power Station through companies like Svante and Promethean Particles.

However, Dr. Griffiths stressed that certain performance benchmarks must still be met. “As we discuss in the paper, MOFs need to achieve 90% CO2 recovery with 95% purity and energy consumption of 3 GJ per ton (approximately) to be competitive with existing technologies. Note, these are performance targets, not yet demonstrated achievements,” he said.

Improvements in water tolerance and cycle stability have been significant, but the commercialisation timeline remains uncertain.

Aiding UAE industries

When it comes to regional integration, Dr. Griffiths believes these technologies have a natural fit with the UAE’s sustainability ambitions, mainly in areas like clean hydrogen production, industrial decarbonisation, and emerging carbon markets.

“We identify in the paper several applications relevant to the UAE and region,” he said. “Steam methane reforming for hydrogen production, which requires carbon capture to reduce emissions, is highlighted as achieving 96-99% CO2 concentration in exhaust streams, making capture highly efficient. We note that electroswing technologies benefit from curtailed renewable electricity cost, which aligns with the UAE’s great solar potential.”

Enhanced oil recovery remains an established use for captured CO2, but the focus, he emphasised, is shifting. “Carbon capture technologies are central to the sustainability and economic plans of the UAE and the broader GCC,” he said. “The focus is shifting from using CO2 for enhanced oil recovery to enabling large-scale industrial decarbonisation and the production of low-carbon fuels.”

The scale of ambition is significant. “For instance, in the UAE ADNOC targets 10 MtCO2/yr of capture capacity by 2030, Saudi Arabia is aiming for 44 MtCO2/yr by 2035 and Qatar targets 11 MtCO2/yr by 2035,” he noted. These targets are partly driven by the ambition to export low-carbon hydrogen and ammonia to key markets in Europe such as Germany, and Asia.

“By coupling carbon capture with significant natural gas resources, the region can secure its long-term role as a major energy provider while pursuing net-zero goals,” Dr. Griffiths concluded.